Business Finance Case Studies 1

Q1.

- MYOB will receive $1,094,117.28 now, after the discounted installment contract.

- The annual operating revenue after 5 years for MYOB will be $720,264,069.60

- MYOB would pick the loan option with the lowest EAR, which is option C 5.54% compounding daily @ 5.4%.

EAR- A: 5.58%

EAR- B: 5.57%

EAR- C: 5.54%

- Quarter payments are $12,699.93, the loan is amortized on monthly payments, with quarterly compounding of interest which is adjusted accordingly.

|

Principal |

420,000 |

|

Interest rate (monthly) - After Compounding Adjustment |

0.321% |

|

Term (months) |

120 |

|

Repayments per month: |

4,223 |

|

Repayments per Quarter: |

12,699.93 |

- The Yield to Maturity on the bonds is 5.356%.

- The Coupon Payment is $35.

Q2.

Expected Return =YTM(Risk-Free Rate)+(Beta x Market Rate Premium)

Expected Return-MYOB = 1.9%+(0.36x6%)

Expected Return-HYPO = 1.9%+(-0.2x6%)

|

Australian Bond-10yr-05/04/19 |

1.9% |

|

Beta 5Y-MYOB |

0.36 |

|

Hypothetical-Company-Beta |

-0.2 |

|

Market rate premium |

6% |

|

Expected Return-MYOB |

4.06% |

|

Expected Return-HYP |

0.70% |

b.

Weighted Average

Portfolio Return = (Return x Weightage) + (Return x Weightage)

Portfolio Return = (4.06%x 50%) + (0.70% x 50%)

Portfolio Beta= (Beta x Weightage) + (Beta x Weightage)

Portfolio Beta= (0.36x 50%) + (-0.2 x 50%)

|

Portfolio Return |

2.380% |

|

Portfolio Beta |

0.08 |

Q3.

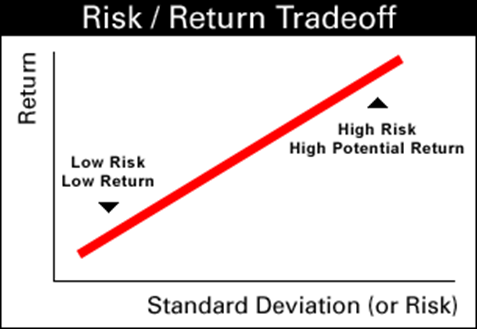

Risk and return are the contrasting concepts in finance and a comparative analysis between them can result into a deep analysis on the investment, as for an investor the term risk is the chance that an investment's return will deviate from what is expected, this can be analyzed by standard deviation, return on the other hand which is the driving force for any investment can be calculated by the Lets first analyze the returns. The lower the level of risk the potential return is likely to be low as well; the higher risk is associated with high returns it is called the Risk-Return Tradeoff.

Different investors vary in tolerance level for the risk they are willing to take, some investors will invest in only a low-return investment where the risk is also low, and other investors are willing to take high risk in pursuit for attaining a high return with the risk of losing their entire investment looming. The bottom left corner of the graph shows that there is low risk in the investment, mostly low-risk low return investments are government bonds, or government issued instruments which can be nearly considered as risk-free investments.

The top right portion of the graph indicates the high-risk instruments or investments which yields high returns or high loss in capital. These risks can be minimized by portfolio investment, but it all depends on the expected required rate of return for the investor.

The organization MYOB provides cloud business management software solutions with a product diversification of over 50 ranging from payroll, accounts, tax, etc. MYOB has been constantly gaining on its revenue and profit. The share price historical data indicates that the organizations stock has a low risk with low returns. The Australian application software industry has 4 major players Wisetech Global (with a 5Ybeta of 1.72) leads the race amongst the competitors following t is Technology One (with a 5Ybeta of 0.46), the third major player is IRESS Limited (with a 5Ybeta of 0.43) and the fourth in list is MYOB Global (with a 5Y beta of 0.36), beta shows a clear reflection that how the industry is maneuvered by the volatility and the relationship of the stock with the market. Wisetech has a more volatile relationship with the market having a beta above one whereas rest of the three major players are less volatile than the market, which means that MYOB global is not affected greatly by the market movement. With data of market premium and risk free rate, the expected return for MYOB is 4.06%, a combination with a more volatile investment like Wisetech Global can make a balanced portfolio the expected rate of return would be 12.22%, and the combination will have a portfolio return of 8.14% with a Portfolio Beta of 1.04.

The diversification within an industry can prove to be substantial as all the external risk factors to these investments would be the same. There will be no additional risk involved in this portfolio. There is a high return chance of obtaining a profit on investment by sticking into this industry, the trends of this industry show phenomenal growth, the organizations are now migrating towards cloud solutions, MYOB can prove to be a major player with the increasing demand from the industry.

Risk management is vital for investor or organization to make efficient decisions on investment. There are different types of risks

- Economic Risk

Overall impacts the economy as a whole, conditions can be normal to boom and recession. There can be inflation or deflation, changes in employment and interest rate.

Get Assignment Help from Me