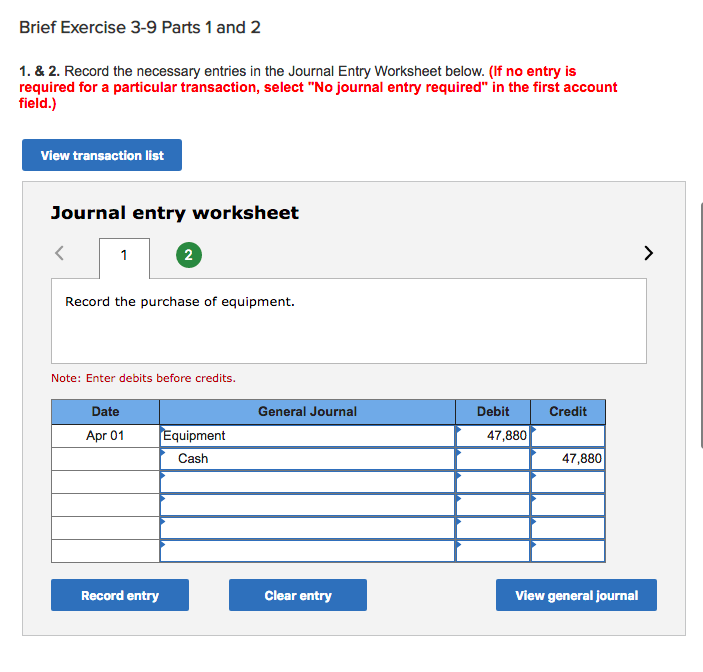

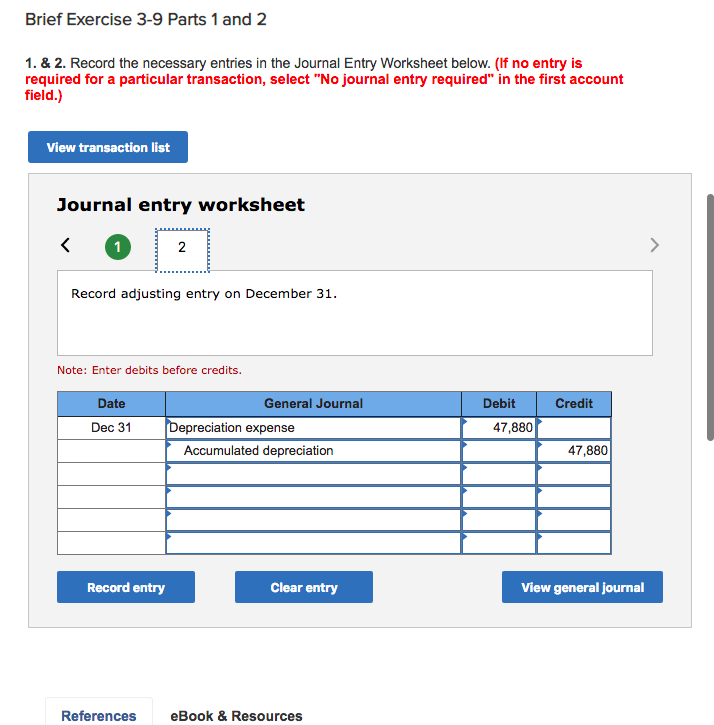

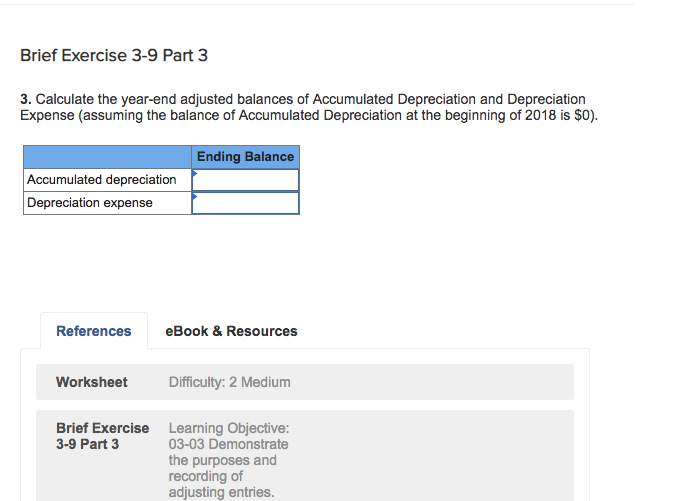

Beaver Construction purchases new equipment for $47,880 cash on April 1, 2018. At the time of purchase, the equipment is expected to be used in operations for seven years (84 months) and have no resale or scrap value at the end. Beaver depreciates equipment evenly over the 84 months ($570/month).

Transcribed image text: Brief Exercise 3-9 Parts 1 and 2 1. & 2. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record the purchase of equipment. Note: Enter debits before credits. Date General Journal Debit Credit Apr 01Equipment 47,880 Cash 47,880 Record entry Clear entry View general journal

Expert's Answer

Chat with our Experts

Want to contact us directly? No Problem. We are always here for you

Your future, our responsibilty submit your task on time.

Order NowGet Online

Assignment Help Services