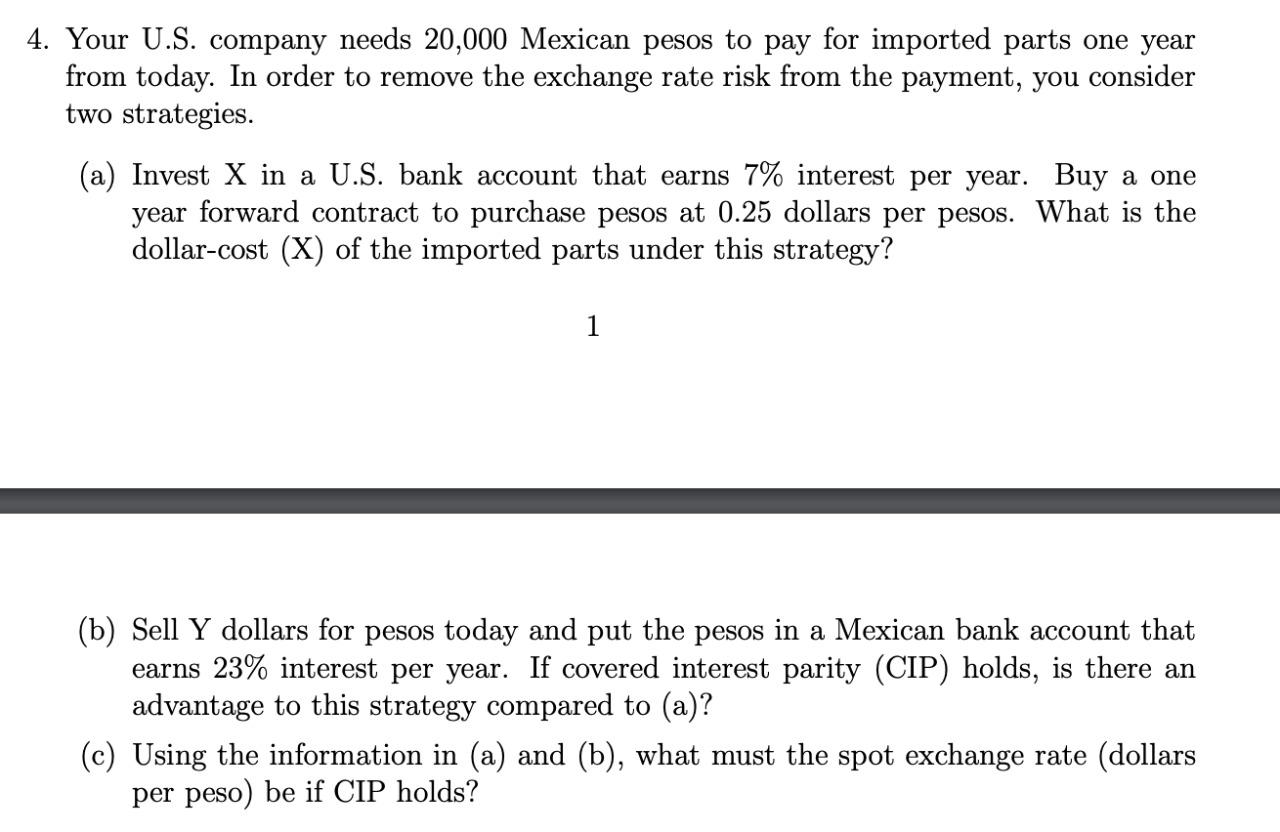

Transcribed image text: 4. Your U.S. company needs 20,000 Mexican pesos to pay for imported parts one year from today. In order to remove the exchange rate risk from the payment, you consider two strategies. (a) Invest X in a U.S. bank account that earns 7% interest per year. Buy a one year forward contract to purchase pesos at 0.25 dollars per pesos. What is the dollar-cost (X) of the imported parts under this strategy? 1 a (b) Sell Y dollars for pesos today and put the pesos in a Mexican bank account that earns 23% interest per year. If covered interest parity (CIP) holds, is there an advantage to this strategy compared to (a)? (c) Using the information in (a) and (b), what must the spot exchange rate (dollars per peso) be if CIP holds?

Expert's Answer

Chat with our Experts

Want to contact us directly? No Problem. We are always here for you

Your future, our responsibilty submit your task on time.

Order NowGet Online

Assignment Help Services