Q1.

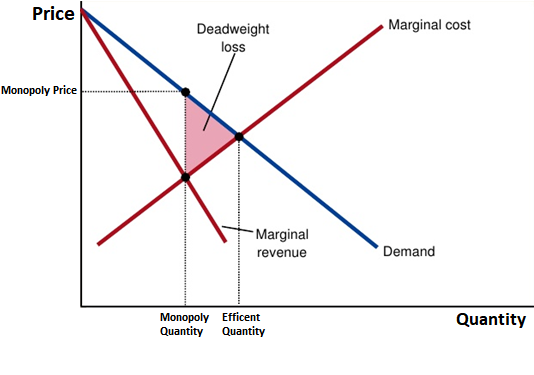

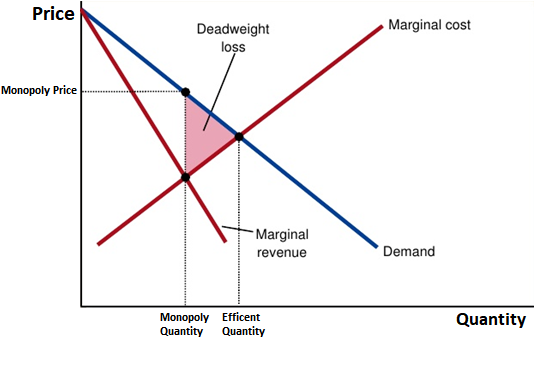

(a) When there is a single seller in the market which means there is monopoly the organization will set a price for the product for its customers, the quantity of the goods will be less than the price of the product to make it a good commodity product. The monopoly companies marginal revenue will always be less than the price of the good, being a less efficient market in total gains as compared to the competitive market the demand in monopoly is always slipping downwards, it has a wedge between the customers willingness to pay and the selling price of the product, this results in deadweight loss. The wedge also causes the quantity sold to be less than the efficient quantity to achieve social optimum. It is the potential gain that the firm did not acquire from the consumers. The combined surplus of the monopoly is less than what could have been obtained in a competitive market. Socially efficient quality is when the demand meets the marginal cost. The firm which is not producing the efficient quantity is an indication of a constant inefficient allocation of resources. Advertisement, product variation, cross transportation, inefficient firms, and excess capacity are all examples wastage of resources in a monopoly (Lumen Learning n.d. a).

(b) Advantages of a monopoly market are as follows:

(a)When there is a single seller in the market which means there is monopoly the organization will set a price for the product for its customers, the quantity of the goods will be less than the price of the product to make it a good commodity product. The monopoly companies marginal revenue will always be less than the price of the good, being a less efficient market in total gains as compared to the competitive market the demand in monopoly is always slipping downwards, it has a wedge between the customers willingness to pay and the selling price of the product, this results in deadweight loss. The wedge also causes the quantity sold to be less than the efficient quantity to achieve social optimum. It is the potential gain that the firm did not acquire from the consumers. The combined surplus of the monopoly is less than what could have been obtained in a competitive market. Socially efficient quality is when the demand meets the marginal cost. The firm which is not producing the efficient quantity is an indication of a constant inefficient allocation of resources. Advertisement, product variation, cross transportation, inefficient firms, and excess capacity are all examples wastage of resources in a monopoly (Lumen Learning n.d. a).

- Stability of prices is seen in the market, as there is no competition in the market and the firm can set its own price for the product to reach the desired goal.

- Economies of scale can be achieved by large scale production to have a low cost for the product which eventually leads up to the benefit of the consumer

- The monopoly firm is obtaining huge profits, research and development can help the firm to sustain for a longer period of time with efficiency. The revenue generated can be invested back on the research and development

Disadvantages of a monopoly market are as follows:

- There is less choice for the customer to consume a product or service.

- Higher prices are a major disadvantage in the monopoly market, with also price discrimination where the firm charges different amounts of money from different consumers within the same market.

- The quality of the product can be in question as the firm focuses on production but not quality as there is no alternative to the products.

Q2.

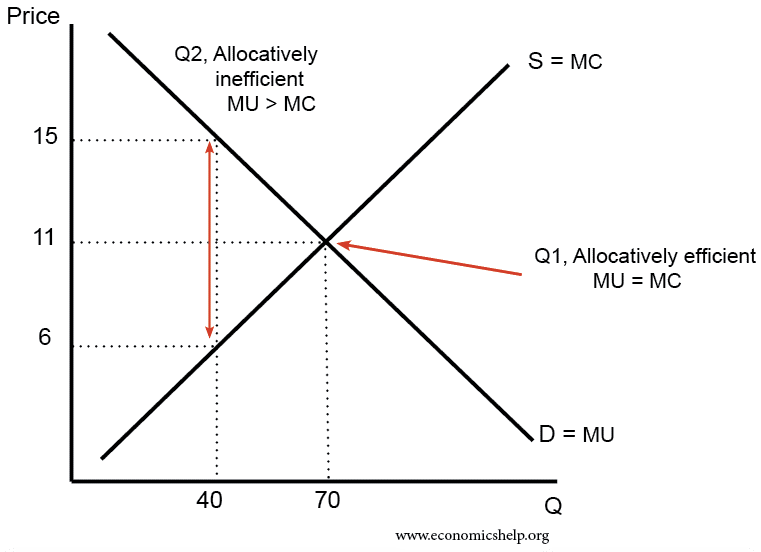

(a) Allocative efficiency is a concept where the output of the product is close to the marginal cost which is the optimal level of efficiency, it is a concept which has the optimal level for the allocation of resources where both consumers and producers benefit. Perfect competition is the market structure which is the benchmark for allocative efficiency. There are many reasons to use it, firstly the optimal use of resources which maximizes value for customer and firm. In the allocative efficiency, the opportunity cost is availed which refers to the maximum benefit an organization can obtain. Economies of scale have the assurance that the opportunity cost will decrease with the increase in production. Market equilibrium is achieved and has been maximized for society as a whole. The diagram where the price of the product is equal to the marginal cost is where optimal allocative efficiency is achieved P=MC (Economics Help n.d.).

Q4(b) Allocative efficiency occurs only when the good is produced at a level where it will maximize the social welfare when the price equals the marginal cost since the monopolistic competitive firm's price always exceeds the marginal cost the firms can never achieve allocative efficiency. We refer to the graph to see that the monopoly price is at a higher point than the marginal cost making P > MC it can be concluded that it cannot achieve allocative efficiency.

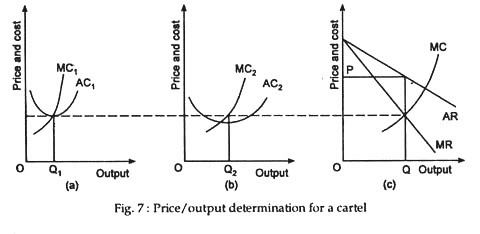

(a) Few sellers in the market who recognize that their prices and product nature are similar, the large firms which mainly have a larger chunk of the market share gets an opportunity to reduce uncertainty and have a collusion behavior with the firm, it might be a formal or an informal type of agreement. In oligopoly collusion, the firms are affected not only by their products but even with the production decisions of other firms in the market. This will generally act as a monopolistic market for all the firms within the agreement of collusion. The firms set price and quantity which will have the maximization on the industry economics, the same scenario is achieved in profit-maximizing monopoly. Each firm then allocates the production resources by equating the marginal cost of the firm to the marginal revenue of the industry. In the graph below we can see how two firms are achieving monopoly and have a different output to achieve the maximum profit for their firm (Economics Discussion n.d.).

|

Source: (Economics Discussion) |

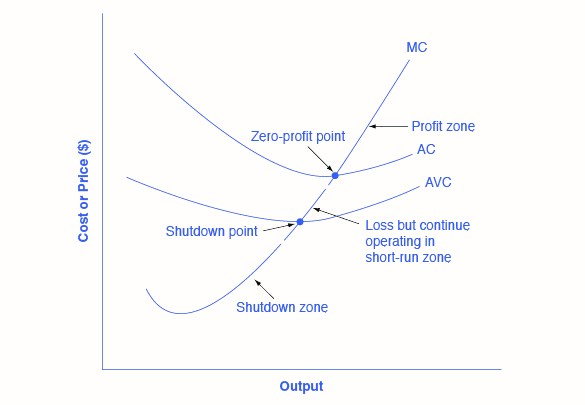

(b) If one of the firms changes its price both of them will face a kinked demand curve. There are two possibilities for the other firm, first is not to change the price which would result in a higher market share, this will also impact the demand curve to be more elastic. If the firm decides to raise the prices the consumers will shift to other firms and revenue with the market share will be lost. This will create a kink in the demand curve, where the demand can be very elastic at the higher price and very inelastic at the lower price. Marginal revenue also has a kink due to the dependency on price, the lower price will have a gap in the marginal revenue, whereas the marginal cost will be the same as the production is not impacted by this as long as the marginal cost is within the gap of marginal revenue.

Read More

Get Assignment Help from Me