- Services

- Academic Writing Service

- Assignment Help

- Academic Assignment Help

- Assignment Writers

- Custom Writing Services

- Online Assignment Help

- Effective Note-taking – Assignment Help

- Assignment Help Australia

- Write My Assignment

- Help on Assignments

- Buy Assignment Online

- Best Assignment Helper

- Assignment Paper Help

- College Assignment Help

- Help with Assignments Online

- Get Assignment Help

- Homework Assignment Help

- Thesis Writing Services

- Online Assignment Writer

- Collect material

- Assignment By Cities

- Assignments by Universities

- Essays

- Essay Writing Guide

- Essay Help

- Argumentative Essay

- Critical Essay

- Essay Writing Help on Comparison Essay

- College Essay

- Deductive Essay

- Essay Writer

- Admission Essay

- Online Essay Help

- Do My Essay Online

- Evaluative Essay

- History Essay Help

- Research Essay Help

- Urgent Essay Help

- Top Quality Essay

- Top Essay Writing Companies

- Cheap Essay Writing Help

- Professional Essay Help

- Cheap Essay Writer

- Essay Writers Online

- Need Help Writing Essay

- Essay Homework Help

- Write Essay Online

- Types of Essay

- Essay Writing Tips

- Essay Help Cities

- Other Services

- Dissertation Writing Assignment Help

- Cheap Assignment Help

- Creating An Appendix

- Assignment Help Tutors

- Assignment Assistance Australia

- Student Assignment Help

- Last Minute Assignment Help

- Urgent Assignment Help

- Assignment Provider

- Do My Assignment Help

- Make My Assignment For Me

- Solve My Assignment

- Custom Assignment Writing

- How to Write a Dissertation – Assignment Help

- Quality Assignment Help

- Write My Assignment For Me

- Assignment Writing Tips

- Buy Assignment

- Article Writing Service

- Assignment Help UK

- Animation Assignment Help

- Coursework Help

- College Assignment Help

- Leadership Assignment Help

- Network Planning Assignment Help

- Dissertation Proposal Writing Help

- Report Writing Help

- My Assignment Help

- Microsoft PowerPoint Presentation

- Pecha Kucha Presentation Help

- Pestel Analysis Assignment Help

- University Assignment Help

- Video Presentation Assignment Help

- Academic Writing Service

- Homework Help

- Subjects

- Sample Assignments

- Resources

- Blogs

- Get a Quote

Assignment Question with corrected dates: Consolidation worksheet, previously held investment in subsidiary

On 1 August 2018, Erik Ltd acquired 10% of the shares in Finn Ltd for $8000. Erik Ltd used the fair value method to measure this investment with movements in fair value being recognised in profit or loss. At 1 July 2017, the fair value of this investment was $15 400. The original investment in Finn Ltd was due to the fact that Finn Ltd was undertaking research into particular microbiological elements that could influence the profitability of Erik Ltd. With the continuing success of this research, Erik Ltd decided to acquire the remaining shares (cum div.) in Finn Ltd.

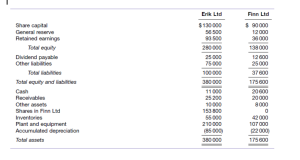

On 1 July 2017, Erik Ltd made an offer to buy the remaining shares in Finn Ltd for $151 000 cash. This offer was accepted by the shareholders of Finn Ltd. On 1 July 2017, immediately after the business combination, the statement of financial position of Finn Ltd was as follows:

On analysing the financial statements of Finn Ltd, Erik Ltd determined that all the assets and liabilities recorded by Finn Ltd were shown at amounts equal to their fair values except for:

The plant and equipment is expected to have a further 4-year life and is depreciated on a straight-line basis. The inventory was all sold by 30 June 2018.

Finn Ltd had expensed all the outlays on research and development. Erik Ltd placed a fair value of $12 000 on this asset. Finn Ltd also had reported a contingent liability at 30 June 2017 in relation to claims by customers for damaged goods. Erik Ltd placed a fair value of $3000 on these claims. The research and development is amortised evenly over a 10-year period. The claims by customers were settled in May 2018 for $2800.

The company tax rate is 30%.

Required

- Prepare the consolidated financial statements of Erik Ltd at 1 July 2017, immediately after the business combination.

- Prepare the consolidation worksheet entries at 30 June 2018.

Expert's Answer

Chat with our Experts

Want to contact us directly? No Problem. We are always here for you