FNS50615 Assignment 1 -Diploma of Financial Planning

As an authorised representative for the AFSL, you need to provide compliant advise for the financial products and services that meets the customers and clients needs and expectations, you are required to have essential knowledge and skills for the financial services sector and the industry professional approaches to procedures, guidelines, policies, and standards, including the ethical requirements.

Tips: In order to assist you in completing this assessment successfully you will need to research the information from the websites and refer to your student learning resources provided.

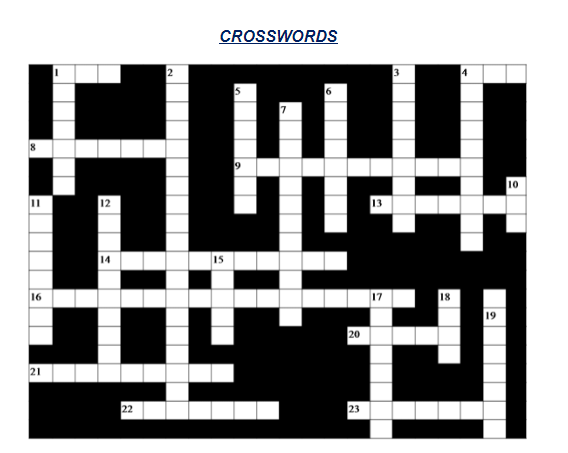

Answer the questions and complete the crosswords given below:

- In your own words explain the role of the financial services sector in the nation’s economy.

- Identify the financial institutions that provide financial products and services to manage people’s wealth.

- List the financial products and services offered by the financial institutions.

- Outline your obligations to provide compliant financial services to the clients.

- Outline the personnel whom you could consult that enables you to provide efficient customer services.

|

Across |

Down |

|

1. The current Uniform Consumer Credit Code Act was written in 199__? 4. PAYG stands for ______ as you go. 8. All businesses that undertake financial services must hold an Australian Financial Services _________. 9. The act that makes provision for superannuation is called the Superannuation Industry ________ Act. 13. One of the key sectors in the financial services industry. 14. The ACCC promotes “_________ and fair trade in the marketplace to benefit consumers, businesses and the community.” 16. Another name for external environment. 20. Financial records must be kept for how many years? |

1. A code of practice sets out the __________ standards consumers can expect when dealing with a company that complies with that code. 2. A form of insurance for employers to cover costs associated with workplace injuries to an employee (two words). 3. If a customer is not happy with a bank’s response to their complaint, they can take the matter to the Banking and Financial Services _________. 4. One of the key bodies used to provide financial stability is the Australian _______ Regulatory Agency. 5. Australian banks, building societies and credit unions are collectively known as Approved ________ Institutions. 6. Discrimination can take two forms, direct and _________ discrimination. |

|

21. Individuals with a bad credit rating are usually on a _________. 22. When working in the financial services industry it is important to ________ your external environment. 23. The aim of regulation of the financial services sector is to ________ consumers. |

7. Under the _______ Act, all companies must keep written financial records explaining their transactions, financial performance and position. 10. One of the discrimination acts. 11.A key external environment to monitor in the financial services industry. 12. EFT stands for ________ funds transfer. 15. The financial services are the ________ largest sector in the economy. 17. The administering commonwealth department for the Financial Services Reform Act. 18. A deposit-taking institution is a _______. 19. A good way to monitor the political environment is to go to the relevant Australian Government _________. |

Expert's Answer

Chat with our Experts

Want to contact us directly? No Problem. We are always here for you

Get Online

Assignment Help Services